Paying Your Yearly Dues

Here's a quick, and we hope useful, article about paying some official dues.

Predial (pronounced pray-dee-AHL)

What does it mean? Well, upon research on the internet, we've learned that it is short for impuesto predial. Impuesto means "tax"... and impuesto predial translates to "property tax", but predial doesn't mean "property". At first we were confused, wanting rational explanations for everything. Now, of course, we know better and we just accept it the way it is.

At the first of the year, anyone who owns property here needs to pay their predial. Yes, you'll probably get a notice under your door or in your mailbox, but no need to wait for that (and if the wind blows away your receipt, of course, you still have to pay it). You can saunter on down to the Tesorería Municipal (City Treasury) on Calle 62 (next to Pan e Vino Restaurante), go in, give them your address, and pay on the spot. Well, that's the most traditional way of paying. Optional places include the internet, the Catastro office, the Police Station on Calle 57, at any OXXO or Dinosusa and in offices set up around the city in cemeteries and shopping malls.

Don't be surprised if this year, your predial has risen by fifty or one-hundred percent. There's a new government and they have a lot of work to do around here. So instead of paying three hundred pesos this year, you might be paying six hundred. We like to remember our tax pesos everytime we pass a fachada (facade) that the city is restoring free to the owner of the building... even at a fifty percent hike, we think it's well worth it. Oh, and even though the predial isn't REALLY due for a few more months, there's a discount if you pay early.

Why a discount? Well, apparently, we are among the few who pay their predial happily and the city seems to have trouble collecting. So, there are discounts: 12-15% discount if you pay in January, 10% in February and 8% in March. There are also other rather interesting incentives. If you are jubilado (retired), you might get a discount up to 100%! You can pay with a credit card and get a discount from the bank. People who pay early might win any number of prizes, including two brand new cars, 15 trips to the Riviera Maya, 12 laptop computers and 12 Sony Wiis!

After you pay, and we know you will, be sure to keep your predial receipt... it is a very important legal document. The best thing to do would be to make a copy for your files or accountant, and staple the original to the escritura (deed) for the property in question. You will be required to show your most recent predial receipt when you sell your property, so doing this avoids future headaches.

Tenencia and Referendo

Both these words refer to taxes on your motor vehicle. The Derecho Vehicular, commonly known as a referendo, is a fixed amount. The tenencia is different for each car, and is calculated based on the value of the car.

If your car is 10 years old or less you will pay a referendo and the tenencia. If your car is older than 10 years, you will only pay the Derecho Vehicular or referendo.

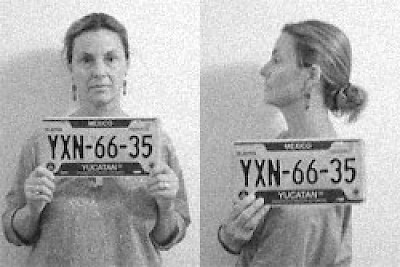

Placas (license plates) are of course mandatory for every car, regardless of age, and you probably already have those. (If you don't, please see this very popular article on Yucatan Living). This article was written back in 2006 and we were contemplating updating it because surely things have changed by now. But today, our assistant, the amazing Beatriz, told us that she got a new (used) car over the holidays and spent TWO DAYS getting her placas.

If you don't want to pay thru the internet (or you can't, which is more likely), you will have to go to any of the Modulos de Vialidad y Padron Vehicular (you know what that means, right? No? Well, it's something like Little Offices Having To Do with Roads and Vehicles... you get the idea). There is one near the Centenario Zoo and Parque de la Paz, and another one in the parking lot of Chedrahui Norte (across from Gran Plaza). There is rumoured to be one by Kukulcan Stadium and nobody within shouting distance knows where the fourth one is.

Here is a little known fact for our readers: our sources tell us that you will pay LESS tenencia for a fully-equipped Hummer H2 pickup with leather seats, or for a luxury Cadillac pickup truck with chromed alloys than you will pay for a small cheap car with no air conditioning. Apparently, that is because the aforementioned pickups, even though they cost as much as $750K MXN, are considered "working-vehicles" and the government gives them a tax break. (We remember the US Government doing something similar... funny, that!) As far as we know, there is no discount for paying your tenencia or referendo on time. But we understand you will get to trade in your old license plates for a brand new pair!

And here is another newsflash: the tenencia will STOP being collected on December 31st 2011. Yes, you read that right. The tenencia will disappear just before 2012... does this perhaps have something to do with the Mayan prediction of the end of the world? Actually, the tenencia will stop being a FEDERAL tax at that point. The federal government is going to leave it up to state governments to create and administer a similar tax of their own. So tenencia will probably still be around, but it will likely have another name, just to confuse us.

So now you know the two or three taxes you have to pay at the beginning of the year in Mexico: property tax and one or two motor vehicle taxes. Time to get on it! Of course, this is Mexico, so no hay prisa (there's no rush). You have until June 2009 to pay them.

EDITORS UPDATE - How to pay for your new Placas:

Now that we've actually gone through the process ourselves, we can tell you what documents you need and where to go to pay your tenencias, your referendos and to get your new placas.

If the car in question is registered in your name (in Yucatan), to pay your fees, trade in your old and get your new placas, you will need:

- Comprobante de domicilio in your name... the original to show them, and a copy to leave with them. (For those of you not familiar with the term comprabante, it means a bill from a utility company with your name and address on it)

- Photo ID (original and copy). Expats need their passport and FM3 (copies of the section listing your status and the prorrogas (renewals))

- The old placas (license plates)

- Money to pay any fines or debts on record for the auto in question

If the car is in your name but you are sending someone else to get your placas, you will need:

- Everything listed above

- A carta poder (power of attorney) with your signature and the signature of the person you are sending (original and a copy). The carta poder needs to be in Spanish, of course. It should have a date at the top. It only needs to say:

- A quien Corresponda,

Por medio de la presente autorizo a (the name of the person you are sending) quien se encuentra identificada a realizar mi cambio de placa de mi vehículo marca (Car Manufacturer such as Nissan), modelo (Car Model such as Sentra), número de serie (the Vehicle ID number), número de placa (your old License plate number).

- And it needs to be signed, with your name printed below

- A quien Corresponda,

- original and copy of the ID of the person you are sending

If the car is not under your name or doesn’t have Yucatan placas, you first have to go get the car put in your name. See this article for more information on that.

If your vehicle is 10 years old or older, you will pay about $350 pesos for the Derecho Vehicular and for the new placas. If your car is less than ten years old, you will pay the tenencias depending on the model, year and price of the vehicle.

At this website, you can pay online if you have a valid Mexican credit card or a Sun Trust Bank card. No other cards are accepted. You can also pay with a debit card from a Mexican bank, as long as the account is in your name and you have a clave elector (a Voter ID Number... basically you have to be a Mexican citizen for this option…).

If you pay online you, you will get a receipt and an appointment to bring in the required documents along with your payment receipt and the old placas. If you cannot pay online (we couldn't), you can print out what it says you owe, and take that in with all your documents. You will pay (at one of the four locations mentioned above) and exchange your placas immediatley thereafter in the same place.

We sent Beatriz, with all the documents and the old placas in hand, to the old penitentiary on the West side of Parque de la Paz (at the junction of Avenida Itzaes and Calle 59, across from the Zoo). She presented all the documents to be checked, and was only able to process one of our cars the first time. Why? Working Gringo's signature on the poder was slightly different from his signature on his passport. Save yourself a trip, and make sure all your signatures match!

After your documents are checked, you will be sent to pay your fees. Once you have paid, you will be sent to another line to exchange your old placas and pick up your new placas. They will review your documents again (Mexico's version of checks and balances... and a full employment policy!) and you will be given your new placas. Is it crowded? Are there long lines? Sometimes. When Beatriz was there, there were about 8 ladies checking the papers and about 20 cashiers. And 5 people handing out the placas.

Take our advice... Mexicans have a way of doing things at the last minute. Exercise your non-mañana nature and do this as soon as you can. The lines get longer, the closer you get to June. Oh, and the Modulos de Vialidad (see approximate locations in article above) are open from 8 am to 8 pm, Monday through Friday. We think they are also open on Saturdays from 8 am to 2 pm... if you find out differently, let us know.

Comments

Alinde OMalley 14 years ago

I so much appreciate this article about where to pay which dues. Even though I've been here for some time, I need refreshers, annually.

But let me add--there may be some changes here. For one, I believe, but am not positive, that new laws have now mandated auto insurance.

Next, I'm unclear myself if I have to pay another tenencia. IF I've been reading the news correctly (a big "IF"), the state of Yucatan may have created tenencia taxes as was permitted by the federal law. So, this week, I'm going to take my old tenencia papers in so see if I need to refile for the exemption.

Reply

Working Gringos 16 years ago

As we understand it, that's about right. If you have real questions, we suggest you pay for an hour of an expert's time at Yucatan Expatriate Services (they have lawyers and accountants on staff there...) and find out exactly what you need to know. They can be reached at http://www.yucatanyes.com .

Reply

CasiYucateco 16 years ago

Ronald, I don't believe that any income tax is charged by Mexico for investment income or social security from the USA. If you are earning income in Mexico, you may owe taxes on that. You will pay property tax on your home, IVA (sales tax) on your purchases, etc, just like everyone else.

You still owe US Income Tax on your retirement income from the USA, regardless of where you live in the world.

I think that is correct, but others should feel free to chime in.

Reply

Ronald Costanza 16 years ago

I read the artical about Paying your yearly dues but I still do not see anything about paying income tax on retirement income like an annuity and/or social security from the US. What is the percentage of gross retirement income that will need to be paid for someone considering retiring to Merida?

Reply

Lourdes 16 years ago

Hi, I need to take the driver's license test in Merida. Is there a webpage to prepare my self for the questionaire, or a Gov. Office in Merida that I can visit and receive info about it?

Thanks!

Reply

Working Gringos 17 years ago

Gregg,

Renewing registration wasn't a problem for our car with US plates until we needed a smog check (California). For a few years, we registered our car as "off the road" which didn't require anything at all... just a few bucks. But yes, the only way to do it would be to travel back to our home state.

You MUST have Mexican insurance when you drive a car in Mexico... especially a car with US plates. There are many places on the web that provide that, and all the local insurers can provide it as well.

Reply

Gregg 17 years ago

If your plates are US, how do you renew registration? Some states cross reference inspection and registration. Do you travel back? Can you insure a car w/US plates and have Mexican insurance?

Reply

Pennsy Al 17 years ago

PREDIAL (contd.)

Boy, was I misinformed about the predial. Thanks, folks, for the correction. Have since found the website of the Municipio of Merida very informative. Its FAQs may be found at https://isla.merida.gob.mx/ServiciosInternet/CarritoElectronico/phpCarWeb001.php?sIdAreaServicio=Finanzas&sIdTramite=PredialAvaluo

Even found that they will email me the folio and RMC (whatever that last acronym stands for) since my wife (source of misinformation on predial) cannot locate the copy we have here in the States of the sales documents. All I need for the query was the address, her name (she bought, to avoid the bank trust business), and her federal registry number (RFC). I gather than once the Municipio can respond, then I will have the folio and RMC, I'll then find our tax obligation and be able to pay it. Wow! Yucatan government works!

While the amount may be small, I like to be current on all obligations.

Reply

Yucatan Living - News: Change is Coming to Merida 17 years ago

[...] a lot of help from the amazing Beatriz. They updated the article about paying yearly dues and fees (here)Â with the exact documents that you need to prepare to get your new plates, and a rundown on the [...]

Reply

Kim G. 17 years ago

Interesting article. Thanks. While I'm no fan of taxes, Mexican property taxes are so low as to be absurd. 300 pesos? 600? At today's exchange rate, that would amount to somewhere between $21 and $42 USD. As a percentage of your property's value, it must be something with quite a few zeros in front of it. Did you mean thousand instead of hundred?

As for the tenencia, well, if it hangs around, it will become a tendencia. And hang around it almost certainly will.

Actually, with the collapse in the oil price, I'd expect quite a few more tax hikes in Mexico. The oil bust has punched a big hole in the federal budget, and it will somehow have to be filled.

Kim G,

Boston, MA

Where "Taxachussets" isn't quite right, but we're hardly low-tax either.

P.S. There's no such thing as a Sony Wii.... nor a Nintendo Playstation for that matter.

Reply

Gregg 17 years ago

Thank you Harald, like a good neighbor...............

Reply

(0 to 11 comments)Next »